By Daniel Korleski, MBA

The period leading up to retirement can feel overwhelming, filled with a mix of emotions. You might be eager to embark on this new life chapter yet stressed about the logistics, all while grappling with the complexities of the Social Security process. It can be particularly challenging when it appears that everyone else has it all figured out, leaving you feeling confused.

In today’s landscape, where a surge in retirees is expected due to the aging baby boomer generation and older adults transitioning from the workforce due to pandemic-related factors, understanding your benefits fully—and how to maximize them—has never been more crucial.

Through this comprehensive guide, our goal is to empower and equip you with the knowledge and confidence needed to optimize your Social Security benefits as you embrace the next phase of life.

How Are Social Security Benefits Calculated?

Your Social Security benefits are calculated by the Social Security Administration (SSA). Benefits are based on lifetime earnings across your 35 highest earning years. You must work a minimum of 10 years to be eligible for benefits. If you have worked less than 35 years, your earnings will be calculated with zeros for the years you have not worked. All past wages are indexed to today’s wages in order to accurately reflect wage growth.

Once your average monthly earnings for your top 35 years are calculated, a special formula is applied and the result is your primary insurance amount (PIA). The PIA is the benefit you are eligible to receive when you reach full retirement age (FRA).

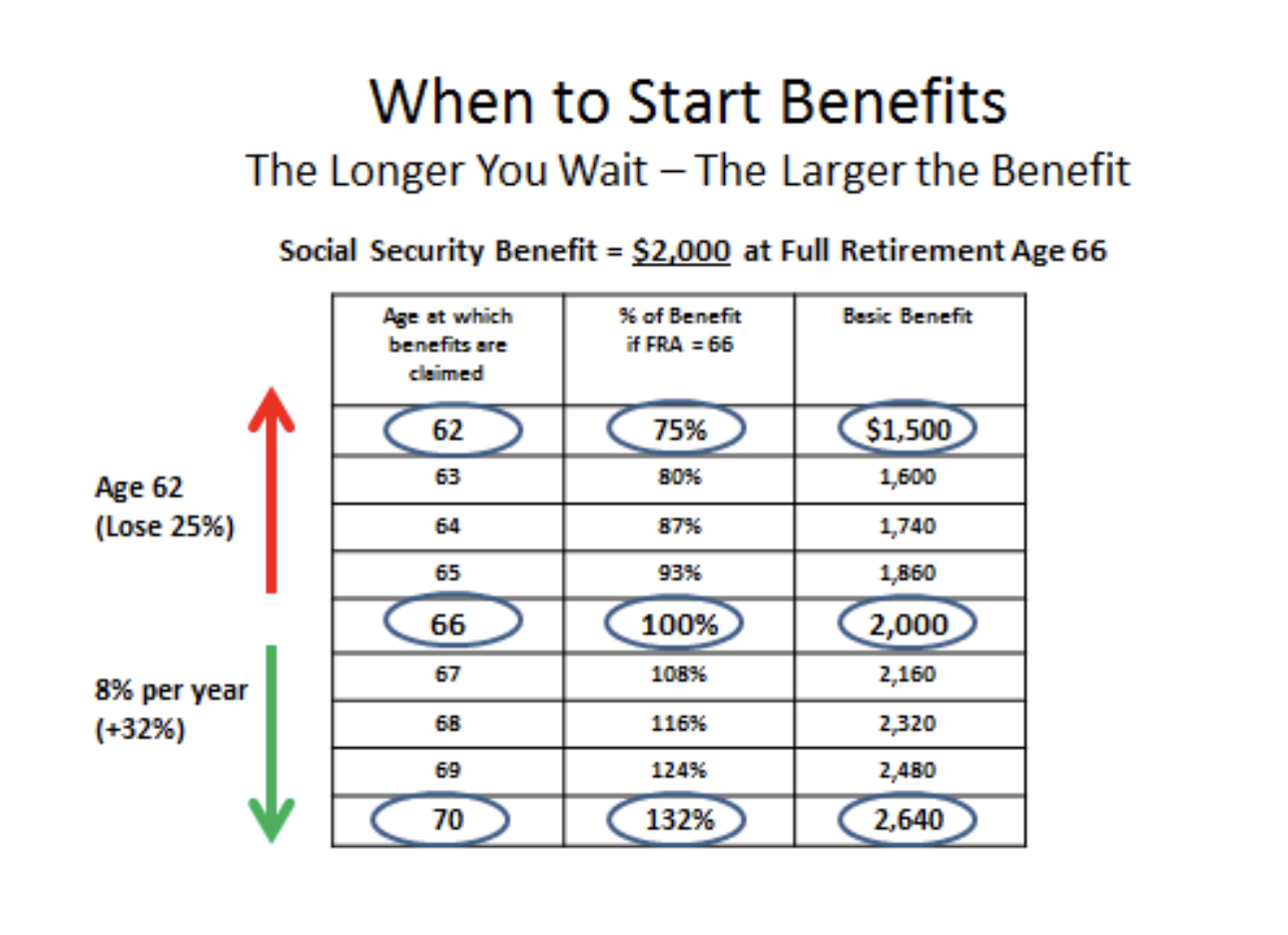

The actual benefit you receive may not be your PIA. This is because your PIA will be increased or decreased depending on when you choose to receive benefits. Taking benefits before FRA will reduce your benefit, and waiting until after FRA will increase your monthly benefit. Also, starting at age 62, your eligible benefits will receive regular cost-of-living adjustments (COLA).

Spousal Benefits

Married people are eligible for benefits based on their spouse’s work history. The spousal benefit is 50% of the working spouse’s earned benefit. In order to receive these benefits, the working spouse must be at least 62 and have already filed for benefits.

If you are divorced, you may also be eligible to receive spousal benefits based on your ex-spouse’s work history. Your marriage needs to have lasted at least 10 years, you must be divorced for at least two years, and you must still be single. In addition, you need to be at least 62 and not eligible for a higher benefit amount based on your own work record. Unlike spousal benefits for married people, your ex-spouse does not need to have filed for benefits in order for you to claim them.

When Can You Claim Social Security Benefits?

You can claim your Social Security benefits anytime between age 62 and age 70. If you continue to delay taking benefits after you reach age 70, there is no additional benefit increase. However, the age at which you choose to collect benefits before 70 will impact the amount of benefit you receive.

Early Retirement

You can start receiving benefits as early as 62, but your monthly benefit will be lower than if you waited longer. Your basic benefit is reduced a fraction of a percent for each month you begin receiving benefits prior to full retirement age. Retiring early can permanently reduce your benefit by up to 30%.

Full Retirement Age

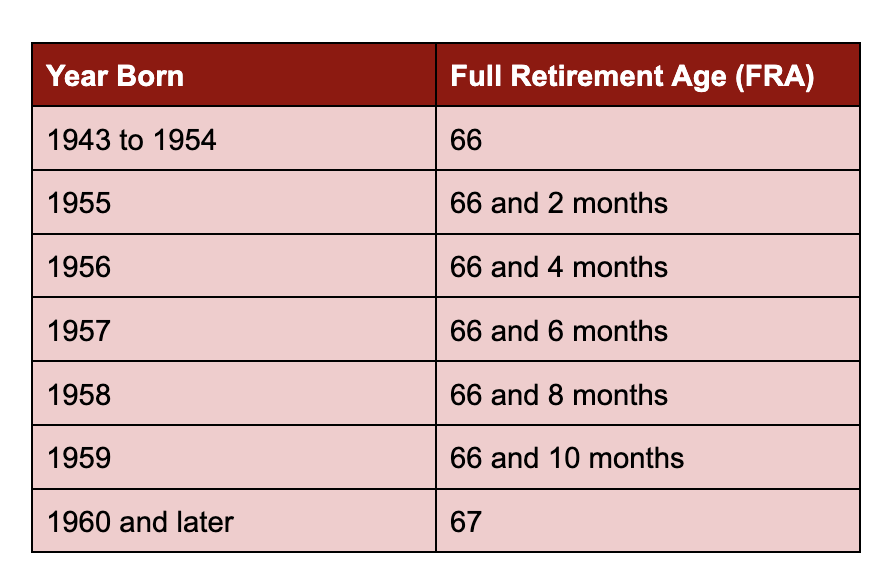

Your full retirement age (FRA) changes based on the year you were born. FRA is 66 for those born between 1943 and 1954 and increases by two months for every year after that you were born until it settles at age 67 for those born in 1960 or later. If you wait until you reach full retirement age to begin collecting your Social Security benefits, you will receive the full PIA that you have earned.

Delayed Benefits

If you’re still working or don’t need the money immediately, you can delay receiving your benefits. Your benefit will increase by 8% for each year that you delay, with a maximum possible increase of 32%. You cannot delay and increase your benefit indefinitely, though. Once you reach age 70, the amount of benefits you receive will not increase any further.

When Is the Best Time to Claim Social Security Benefits?

While you are working, you can increase your future Social Security benefits by earning higher wages. Once you stop working, though, the only influence you have over your benefit is when you begin to take it. Your timing has a great impact on the amount of the benefit you will receive and should be carefully considered.

Social Security Statement

An important document that you will reference during the decision-making process is your Social Security statement. The Social Security Administration mails statements to workers age 60 and over who aren’t receiving Social Security benefits and do not yet have a my Social Security account. These statements will be mailed out three months prior to your birthday, but you can also access the same information by setting up an account on their website.

The statement will tell you your:

- Estimated benefit if taken at age 62

- Estimated benefit if taken at FRA

- Estimated benefit if taken at age 70

- Estimated disability benefit

- Estimated family and survivor benefits

- Medicare information

- Earnings history

All benefit amounts listed are estimates and subject to change. They are calculated based on your date of birth and future estimated taxable earnings.

It is important to review your earnings history and check for accuracy. Your benefit is calculated based on those numbers, so any mistakes can affect your benefits. You should correct any errors as soon as possible.

Deciding When to Claim Benefits

Your Social Security benefits are calculated using complex actuarial equations based on life expectancy and estimated rates of return. They are not designed to encourage early or late retirement. If you live as long as anticipated, the total amount you receive over your lifetime should be about the same whether you claim it at age 62, age 70, or sometime in between. You will either receive the money as a smaller monthly payment over a longer period of time or a larger monthly payment over a shorter period of time.

The best time for you to claim your benefits depends on your personal situation and health. If you expect to live longer than average, your overall lifetime benefit will be greater if you delay claiming your benefits to increase your benefit amount. If the opposite is true and you see little chance of making it into your mid-80s, you would likely receive a greater lifetime benefit by taking it sooner, even though it would be a smaller monthly payment.

Once you decide when you want to start receiving benefits, remember to complete your application three months before the month in which you want your retirement benefits to begin.

Once you decide when you want to start receiving benefits, remember to complete your application three months before the month in which you want your retirement benefits to begin.

How Can Married Couples Maximize Benefits?

Because married people have the ability to receive their own benefit or a spousal benefit, they have more to consider when filing for benefits. With the right strategy, married couples can maximize their benefits.

In the majority of cases, the lower-earning spouse may want to begin collecting benefits early while the higher-earning spouse waits as long as possible. That way, you can access the lesser benefit while maximizing the higher benefit.

Often, it is the husband with the higher benefit and the wife with the lower one. Women also tend to live longer than men. By following this strategy of waiting as long as possible to claim the higher benefit, you not only maximize the husband’s retirement benefit for use while he is alive, but it also maximizes the wife’s survivor benefit when he passes away.

Restricted Application

While it used to be a popular claiming strategy, the Restricted Application is now only available to those born before January 2, 1954. By restricting your application, you can receive a spousal benefit if your spouse is already collecting benefits while allowing your own benefit to continue to grow until age 70. That way, you can begin to receive spousal benefits while maximizing your own benefit.

How Does Working Affect Benefits?

Working does not affect your benefits once you reach FRA, but it does before that. Only earned income, such as wages and self-employment earnings, affects your Social Security benefits. Income from investments, pensions, and annuities do not affect Social Security benefits.

When you are under FRA for the whole year, your Social Security benefit is reduced by $1 for every $2 you earn over $21,240. In the year that you reach FRA, your benefit is reduced by $1 for every $3 you earn over $56,520. Once you reach FRA, your benefit is no longer reduced no matter how much you earn. These dollar amounts adjust each year, so your benefit may change in following years.

2023 Cost-of-Living Adjustment

In 2023 the COLA is 8.7%, which represents the biggest increase in 40 years. This year also saw an increase in the Social Security tax cap. The cap increased from $147,000 to $160,200, meaning Social Security taxes will not be withheld from income earned above that amount.

This substantial increase in benefits will hopefully provide retirees some relief from the rising cost of goods and services. Historically, a COLA that fails to keep pace with inflation only serves to exacerbate financial hardships. It’s important to keep in mind that the COLA will affect pre-retirees and retirees differently. Here’s what to expect based on where you are in your retirement journey.

Retirees Taking Social Security

While this increase is good news for retirees, it’s not a license to change spending habits all that much—as most retirees know all too well.

It will still be necessary to keep track of your finances, spending—and, importantly, your tax liabilities; some beneficiaries could experience increased taxes in the coming years, depending on their thresholds.

Retirees Not Taking Social Security

Retirees who have not started claiming Social Security will still reap the benefits of this increase even if they don’t take Social Security this year. There is never a decrease in the COLA, so the higher payments are here to stay. Keep in mind that, in some cases, it’s worth holding off taking Social Security for several years once you’re eligible as discussed above. Of course, the benefits of doing so vary based on individual circumstances.

Partner With a Trusted Professional

Your choice of when and how to claim your Social Security benefits can arguably be the most important retirement decision you make. Due to the complexities and intricacies that come with this process, seeking guidance from a financial advisor making this step is highly advisable.

At Cobalt Private Wealth, we specialize in providing assistance throughout the Social Security process to guide you to retirement with confidence and readiness for the road ahead. If you’re approaching your golden years and have questions about how Social Security fits into your overall financial plan, we invite you to connect with us. Reach out to me at danielkorleski@cobaltprivatewealth.com or 719-332-3863 to schedule a meeting and begin your journey towards a stable financial future.

About Dan

Daniel Korleski is the President & CEO for Cobalt Private Wealth, where he helps his clients grow, manage, and protect their wealth so they can work toward a stronger financial future. With over 30 years of experience in the financial services industry, Dan has served as the managing director for Investment Trust Company, chief investment officer for the Wealth Management Group at American National Bank in Denver, and regional investment manager for the Greater Colorado Region of the Private Bank at Wells Fargo, where he oversaw the management of over $2 billion. In 2008, he was appointed by the mayor of Colorado Springs to the City’s Investment Advisory Committee. Dan holds an MBA in investment management from Midwestern State University in Wichita Falls, Texas, a Bachelor of Science in Finance from Florida State University, and is a member of both the CFA Society Colorado and The Financial Planning Association.

Dan loves to give of his time to his community and is currently serving as the Board Chair of Catholic Charities of Central Colorado and oversees the Homebound Ministry at St. Paul Catholic Church. He has also served as Chair of the Board of Trustees of Pikes Peak Hospice Foundation, President of the Broadmoor Rotary Club, and Vice President of the Board for the Pikes Peak Chapter of Trout Unlimited. Dan was born and raised in Spain and is fluent in Spanish. When he’s not working, you can find him traveling around the world with his wife of 25 years, Montse, fly fishing, golfing, and hiking with his rescue pup Brandy and Golden Retriever Quique. To learn more about Dan, connect with him on LinkedIn.