By Daniel Korleski, MBA

With a world of information at our fingertips, we can find reviews, history, product specifications, and more details than we’ll ever need about anything we want to buy. In other words, before making a major purchase, we can arm ourselves with information to make the best choice possible.

While creating a retirement plan is in a different category than buying a car or putting an offer on a home, we believe it’s just as significant of an investment and you should know what you’re getting before you pay a penny.

Because we develop custom plans for each client, it’s no easy task to provide one without working with you extensively. However, we wanted to create something that could help you better understand what your potential financial plan could look like so you can see the benefits a plan could bring to your financial life. If you choose to work with us, here is a sample of what you can expect.

What Does a Retirement Plan Include?

Transitioning your assets to income after decades of working hard to build your nest egg is an intimidating thing to do. It’s much more emotionally daunting than the accumulation phase, which can often be a roller coaster of its own as markets go up and down and competing financial priorities come your way. Now it’s time to shift both how you think and how you act as you turn what you’ve accumulated into an income for life.

We walk you through a comprehensive process that leaves no stone unturned. We believe a solid retirement plan should give you a detailed, complete view of your current financial situation, a thorough modeling of where you want to be, and the actions you need to take to reach those goals. It should address all the pieces of your financial puzzle, from stresses and fears to your values and dreams, and include risk factors, cash flow, estate planning, taxes, and income strategies to help bring you clarity and guidance. It is through our planning process that we can help you prepare for life’s expected and unexpected circumstances.

The result is a simple yet powerful road map to guide you toward financial freedom.

See a Sample Retirement Plan

Here is a sample retirement plan that reflects our planning process. It looks at a fictional client’s lifestyle income plan and how we developed it, including identifying their goals, creating a balance sheet, reviewing their cash flow, and more.

Keep in mind that this is only a hypothetical plan presented to illustrate what a client’s plan may resemble should they work with me. The characters and circumstances are completely fictional and are for illustrative purposes only. Be sure to seek the advice of a qualified professional for your particular situation and not rely upon any of the information herein to make personal financial decisions.

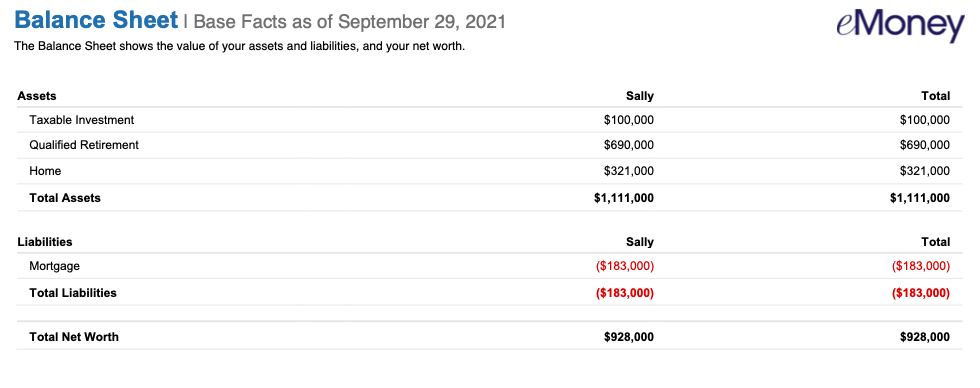

We start by providing an overview of your current situation. With just one glance, you can see a big picture of your financial life, including assets broken down into specific categories and short-term and long-term liabilities.

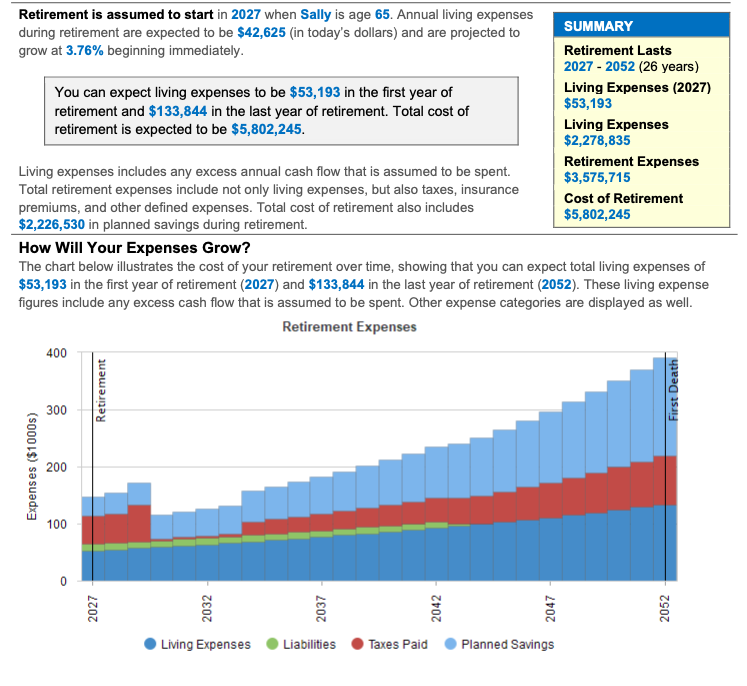

Our financial planning is goals-based. This means we help you develop specific budgets for your future goals and needs—pre and post retirement. This approach allows us to more accurately predict your future spending needs and accommodate for how those needs will change over time. Our advanced planning software allows us to bring all these things together in a comprehensive way that makes sense.

Our financial planning is goals-based. This means we help you develop specific budgets for your future goals and needs—pre and post retirement. This approach allows us to more accurately predict your future spending needs and accommodate for how those needs will change over time. Our advanced planning software allows us to bring all these things together in a comprehensive way that makes sense.

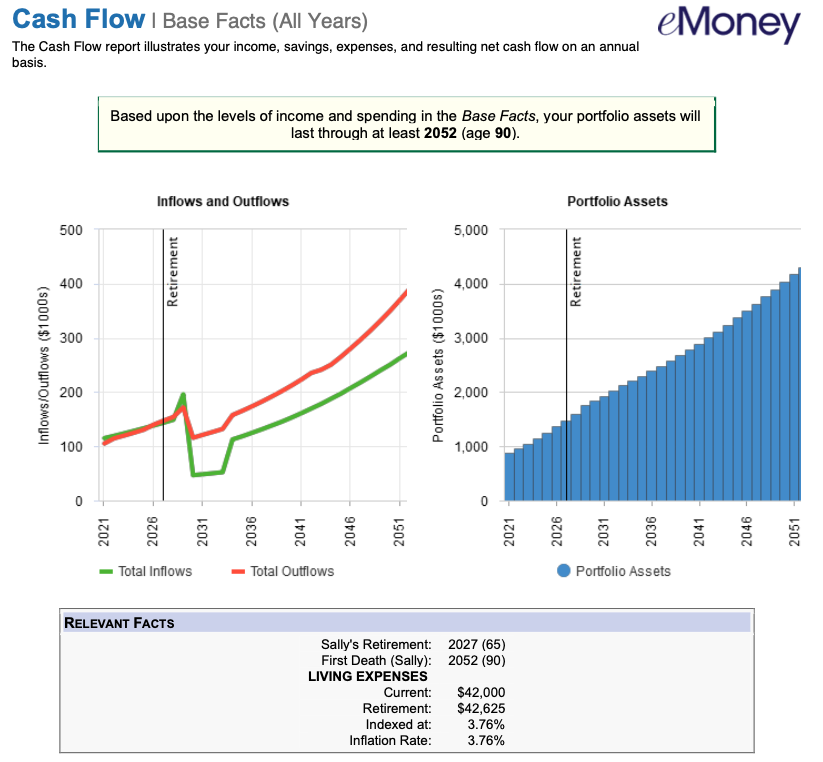

We also build out a detailed cash flow plan, incorporating the assumptions we’ve built and the financial needs and goals we’ve outlined.

We also build out a detailed cash flow plan, incorporating the assumptions we’ve built and the financial needs and goals we’ve outlined.

Finally, we tie it all together with a detailed plan summary that shows you exactly where you stand.

Finally, we tie it all together with a detailed plan summary that shows you exactly where you stand.

In addition to a detailed study of each of your goals and a clearly mapped-out plan to get you there, we also create a risk management plan to cover your bases and help give you increased confidence. The end result? An actionable implementation list and a road map for your future.

In addition to a detailed study of each of your goals and a clearly mapped-out plan to get you there, we also create a risk management plan to cover your bases and help give you increased confidence. The end result? An actionable implementation list and a road map for your future.

Get Started on Your Plan!

If you want to see even more aspects of our retirement plans, download our full sample plan here. Once you’ve taken a look, contact us at Cobalt Private Wealth today to schedule a complimentary consultation by calling 719-332-3863 or emailing danielkorleski@cobaltprivatewealth.com.

About Dan

Daniel Korleski is the President & CEO for Cobalt Private Wealth, where he helps his clients grow, manage, and protect their wealth so they can work toward a stronger financial future. With over 30 years of experience in the financial services industry, Dan has served as the managing director for Investment Trust Company, chief investment officer for the Wealth Management Group at American National Bank in Denver, and regional investment manager for the Greater Colorado Region of the Private Bank at Wells Fargo, where he oversaw the management of over $2 billion. In 2008, he was appointed by the mayor of Colorado Springs to the City’s Investment Advisory Committee. Dan holds an MBA in investment management from Midwestern State University in Wichita Falls, Texas, a Bachelor of Science in Finance from Florida State University, and is a member of both the CFA Society Colorado and The Financial Planning Association.

Dan loves to give of his time to his community and has served as Chair of the Board of Trustees of Pikes Peak Hospice Foundation, the Board of Directors of Catholic Charities of Central Colorado, President of the Broadmoor Rotary Club and Vice President of the Board for the Pikes Peak Chapter of Trout Unlimited. Dan was born and raised in Spain and is fluent in Spanish. When he’s not working, you can find him traveling around the world with his wife of 23 years, Montse, fly fishing, golfing, and hiking with his golden retriever, Curro. To learn more about Dan, connect with him on LinkedIn.