By Daniel Korleski, MBA

Two common types of taxes are widely known: income taxes and sales taxes. Income taxes are deducted automatically from salaries or paid by self-employed individuals and others based on their earnings. On the other hand, sales taxes are typically paid at the time of purchase when buying retail goods and certain services.

But there is another type of tax that might not be as familiar: capital gains tax. These taxes are tied to the profits earned from selling assets like stocks, real estate, or other investments at a higher price than the original purchase cost. Because our team at Cobalt Private Wealth wants to assist you to keep more of your hard-earned money to reach financial success, here are 4 tips that can help you avoid paying out more than necessary.

1. Wait a Little Longer to Sell

Timing the sale of your investments is critical to lowering your capital gains taxes. Selling your shares after holding for less than a year will result in a short-term capital gains tax. This means that all the gains you made from the sale of the stock will be taxed at your ordinary income rate, which can be 32%-37% for high-earners. Holding on to an asset for more than one year will be taxed at the long-term capital gains tax rate, which can be 0%, 15%, or 20%.

Holding periods are also critical when it comes to the sale of real estate. If you sell your primary home and you lived in the home for at least two years of the five-year period before the sale, the IRS allows you to exclude the first $250,000 of capital gains (or $500,000 for a married couple filing jointly). While the capital gains exclusions do not apply to investment properties, you may be able to utilize like-kind exchanges to defer capital gains tax by reinvesting in other real estate.

2. Utilize Tax-Loss Harvesting (TLH)

Losing money on your investments is usually a bad thing, but utilizing a tax-loss harvesting strategy means you can claim capital losses to offset your capital gains. If you show a net capital loss, you can use the loss to reduce your ordinary income by up to $3,000 (or $1,500 if you are married and filing separately). Losses above the IRS limit can be carried over to future years. Sometimes it is advantageous to sell depreciated assets for this reason. A tax-loss harvesting strategy can help minimize your tax liability and keep more money in your pocket. However, trying to reduce taxes shouldn’t come at the expense of maintaining a thoughtful asset allocation in your portfolio.

3. Asset Location

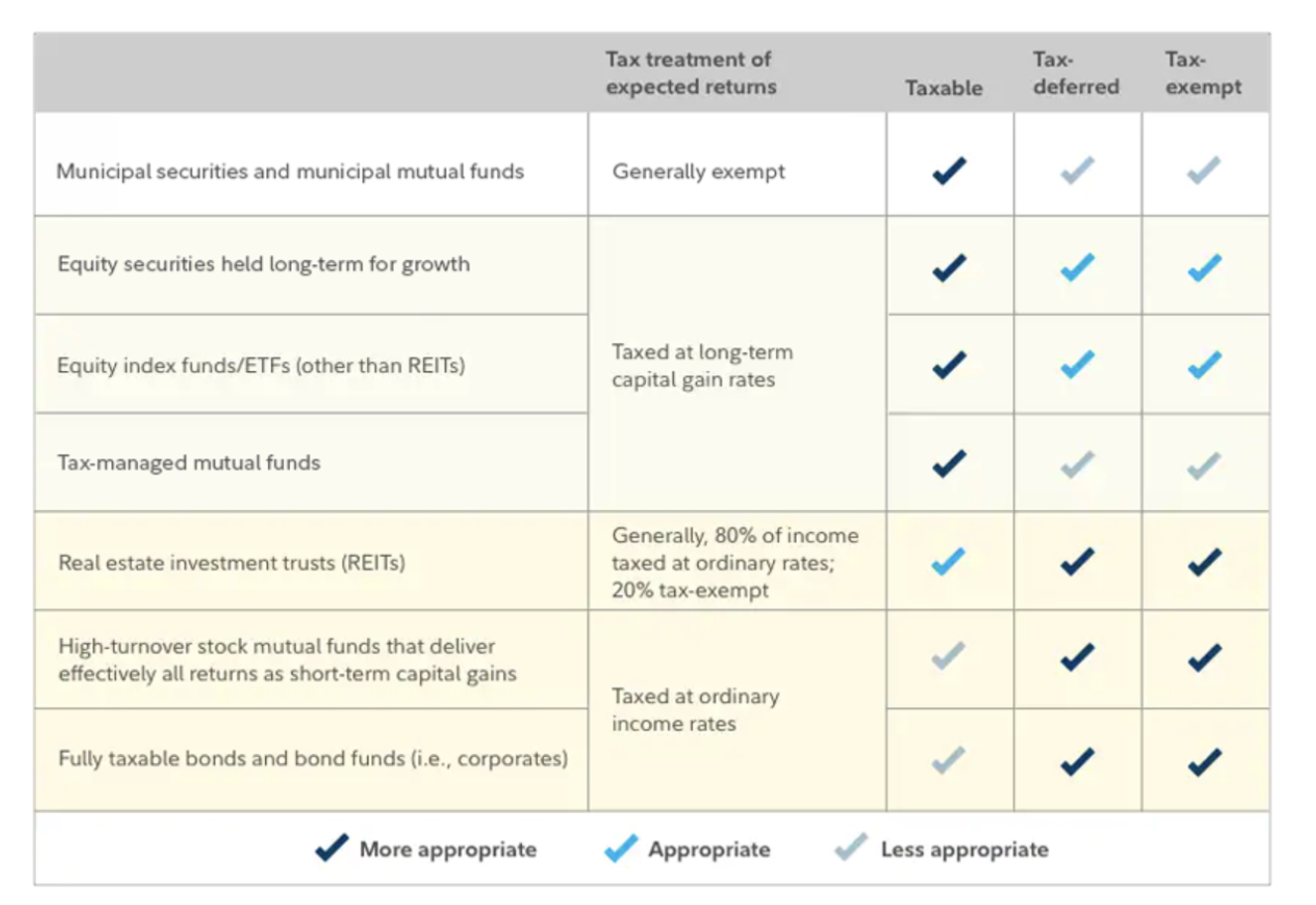

Some investments will be more tax-efficient than others. For example, a municipal bond is considered the most tax-efficient security because income from municipal bonds are federally tax-exempt and may be state tax-exempt. Investments like high-yield bonds are considered less tax-efficient because payments are not tax-exempt, meaning they are taxed as ordinary income. When looking at the table below, assets at the top are more tax-efficient than assets at the bottom.

Source: Fidelity

Source: Fidelity

Like assets, there are investment accounts that are more tax-friendly. Tax-advantaged accounts allow you to defer paying taxes on the gains or earnings to a later date. For example, a traditional IRA or a 401(k) will allow you to contribute using pre-tax income and withdrawals are taxed when you retire, when your income is typically lower.

Pairing tax-advantaged accounts like a 401(k) with tax-inefficient assets like a high-yield bond and pairing taxable accounts (individual, joint, trust, etc.) with more tax-efficient assets will create a more optimal mix to minimize tax liability. Placing investments that have higher tax rates with accounts that delay taxes will help reduce the amount you owe. Since you are not expected to pay federal taxes on something like income from a municipal bond, there is no use placing it in a tax-advantaged account because there are no taxes to delay.

Of course, this is a bit of an oversimplification as there are many nuances that can make certain investment vehicles more tax-efficient than others. For example, although REITs are toward the bottom of the table, there are still plenty of advantages to investing in them. Dividends from REITs are sheltered from corporate tax, and some dividends are considered a return of capital that isn’t taxed at all. This is why it is imperative to work with an experienced professional who can use the nuances of each financial instrument to your advantage.

4. Understand Cost Basis & Share Lots

When you buy any amount of stock, the stock is assigned a lot number regardless of the number of shares. If you have made multiple purchases of the same stock, each purchase is assigned to a different lot number with a different cost basis (determined by the price at the time of each purchase). Consequently, each lot will have appreciated or depreciated in different amounts. Some brokerage accounts use first in, first out (FIFO) by default. If you utilize FIFO, your oldest lots will be sold first. Sometimes FIFO makes sense, but not always. Sometimes it is ideal to sell lots with the highest cost basis, which is commonly done as part of a tax-loss harvesting strategy.

Passing on assets as an inheritance can also increase your cost basis. Assets passed on to the next generation at the time of death allow your heirs to pay tax only on capital gains that occur after they inherit your property, through a one-time “step up in basis.” For example, when one spouse dies, assets passed on to the surviving spouse will have a cost basis of the price of the asset on the day in which they passed. This eliminates the deceased spouse’s portion of capital gains.

A Partner to Support Your Strategy

Reducing capital gains taxes is just one part of promoting your overall financial health because paying these taxes is a good indicator that your investment strategy is thriving. Realizing your financial goals demands a comprehensive approach that considers multiple factors that are tailored to your unique situation.

Collaborating with an experienced and knowledgeable financial professional can support you in crafting an optimized plan to reach those objectives. The Cobalt Private Wealth team is here to help! Schedule a free, no-obligation phone call by reaching out to me at danielkorleski@cobaltprivatewealth.com or 719-332-3863.

About Dan

Daniel Korleski is the President & CEO for Cobalt Private Wealth, where he helps his clients grow, manage, and protect their wealth so they can work toward a stronger financial future. With over 30 years of experience in the financial services industry, Dan has served as the managing director for Investment Trust Company, chief investment officer for the Wealth Management Group at American National Bank in Denver, and regional investment manager for the Greater Colorado Region of the Private Bank at Wells Fargo, where he oversaw the management of over $2 billion. In 2008, he was appointed by the mayor of Colorado Springs to the City’s Investment Advisory Committee. Dan holds an MBA in investment management from Midwestern State University in Wichita Falls, Texas, a Bachelor of Science in Finance from Florida State University, and is a member of both the CFA Society Colorado and The Financial Planning Association.

Dan loves to give of his time to his community and is currently serving as the Board Chair of Catholic Charities of Central Colorado and oversees the Homebound Ministry at St. Paul Catholic Church. He has also served as Chair of the Board of Trustees of Pikes Peak Hospice Foundation, President of the Broadmoor Rotary Club, and Vice President of the Board for the Pikes Peak Chapter of Trout Unlimited. Dan was born and raised in Spain and is fluent in Spanish. When he’s not working, you can find him traveling around the world with his wife of 25 years, Montse, fly fishing, golfing, and hiking with his rescue pup Brandy and Golden Retriever Quique. To learn more about Dan, connect with him on LinkedIn.